Navigating GST: A Comparative Study Between New Zealand and the UK

Understanding the nuances of different tax systems is crucial in the intricate world of international taxation. This article delves into a comparative analysis of the goods and services tax (GST) in New Zealand and the value-added tax (VAT) in the United Kingdom. By exploring their definitions, origins, significance, and the tools available for calculation, such as online calculators, we aim to demystify these prevalent forms of consumption taxes.

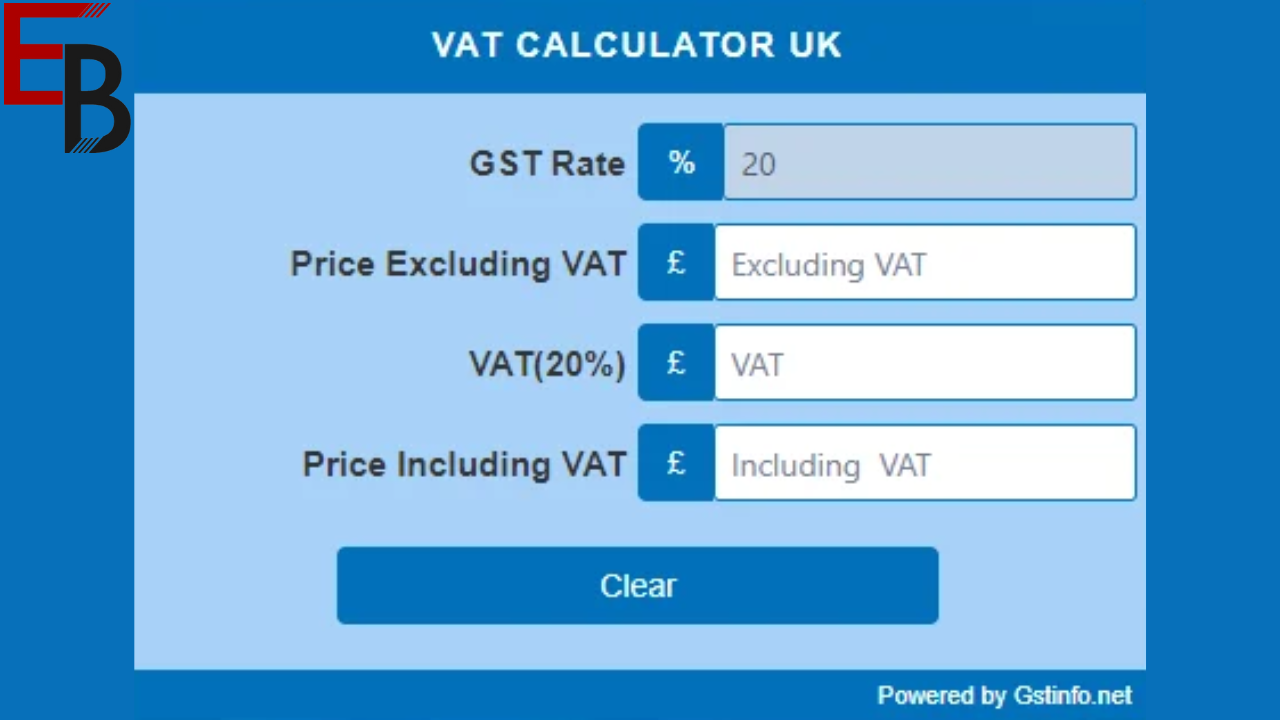

GST and VAT Calculators: Simplifying Taxation

The advent of an online GST calculator NZ in New Zealand and VAT Calculator UK has revolutionized tax calculations. These user-friendly tools allow for quick and accurate assessments of taxes on goods and services, catering to the needs of businesses, accountants, and consumers. They are pivotal in ensuring compliance with tax regulations and are instrumental in financial planning and budgeting.

GST in New Zealand: A Comprehensive Overview

New Zealand’s approach to consumption tax comes in the form of GST, a 15% tax applied uniformly to most goods and services since its introduction in 1986. This single-rate system is notable for its simplicity and minimal exemptions, making it one of the most straightforward tax systems globally.

The Role and Impact of GST in New Zealand

GST funds various public services as a significant revenue stream for the New Zealand government. Its broad-based nature ensures equitable tax distribution and contributes to the overall efficiency of the tax system. The simplicity of the GST structure in New Zealand also aids in reducing administrative and compliance burdens for businesses, fostering a conducive environment for economic growth.

Understanding VAT in the UK

In contrast, the UK’s VAT system, established in 1973, is characterized by its multi-tiered structure. It includes a standard rate of 20%, a reduced rate of 5%, and a zero rate on specific goods and services. This tiered structure allows flexibility and adaptability in the UK’s fiscal policy, aligning with various economic and social objectives.

Comparative Analysis: GST in New Zealand vs. VAT in the UK

Rate Structure and Complexity

New Zealand’s flat GST rate exemplifies simplicity and ease of understanding, contrasting sharply with the UK’s multi-tiered VAT system, which, while offering flexibility, also introduces complexity in compliance and administration.

Scope, Exemptions, and Economic Implications

The broad application of GST in New Zealand, with few exemptions, contrasts with the UK’s VAT system, where various exemptions and zero-rated items reflect a more nuanced approach to consumption taxation. These differences significantly affect each country’s economic policy, consumer behavior, and business operations.

Revenue and Administrative Aspects

In New Zealand, the administration of GST by the Inland Revenue Department is streamlined due to the uniform rate. In contrast, the UK’s HM Revenue and Customs deal with a more complex VAT system, reflecting the diverse economic landscape of the country.

Business Impact and International Trade

The single GST rate in New Zealand simplifies the tax compliance process for businesses, reducing administrative burdens. In contrast, UK businesses must navigate the complexities of various VAT rates, impacting accounting processes and pricing strategies. In terms of international trade, both countries adjust their tax systems to maintain global competitiveness, with specific rules governing exports and imports.

Economic Dynamics and Consumer Impact

The economic impact of GST and VAT extends beyond revenue generation, influencing consumer spending patterns, pricing strategies, and overall economic health. New Zealand’s GST provides a stable and predictable tax environment, while the UK’s VAT system offers flexibility to respond to economic fluctuations and policy changes.

GST Refund in New Zealand

The GST refund system in New Zealand is crucial, especially in international trade and tourism. Tourists and non-residents can claim a refund on the GST paid for goods purchased in New Zealand when exported out of the country, typically at the airport. This refund policy is instrumental in promoting tourism and retail spending by international visitors. For businesses, GST refunds are an integral part of the tax system. Businesses can claim refunds on the GST paid for goods and services used in making taxable supplies, ensuring that the final consumer bears GST. This refund mechanism is vital for maintaining cash flow and operational efficiency, particularly for export-oriented businesses, as it prevents the cascading effect of taxes on exported goods.

VAT Refund in the UK

The VAT refund system in the UK is an important aspect of the tax structure, especially for non-resident visitors and businesses engaged in international trade. Tourists outside the EU can claim a refund on VAT for goods purchased in the UK, provided they take these goods out of the country within a specified time frame. This refund system encourages tourist spending, contributing to the retail and tourism sectors. The VAT refund process is a key component of tax compliance for businesses. Businesses are entitled to reclaim VAT paid on goods and services used for business purposes, which is particularly beneficial for companies involved in exporting goods. This system ensures that VAT is not a cost to businesses but is passed on to the final consumer, thereby maintaining the neutrality of VAT in the business supply chain.

Conclusion

The comparison between GST in New Zealand and VAT in the UK highlights the diversity and complexity of global tax systems. Understanding these differences is essential for international businesses and individuals navigating their tax obligations. Online calculators for GST and VAT calculations ease this complexity, ensuring accuracy and compliance. As the global economic landscape continues to evolve, so will these tax systems, emphasizing the need for ongoing adaptation and understanding in a dynamic fiscal environment.