Ways Traders Set Realistic Expectations When Trading Rectangles

Rectangle chart patterns are the unsung heroes of trading strategies. They offer a visual snapshot of market indecision and potential breakout opportunities. These patterns create a “battle zone” between buyers and sellers, making them a favourite among technical traders. Understanding how to use these formations effectively can turn market confusion into a well-executed plan. Are you ready to unlock their potential? How do traders stay grounded when analyzing market patterns? Aipom Ai connects investors with educational experts who simplify complex strategies for better decision-making.

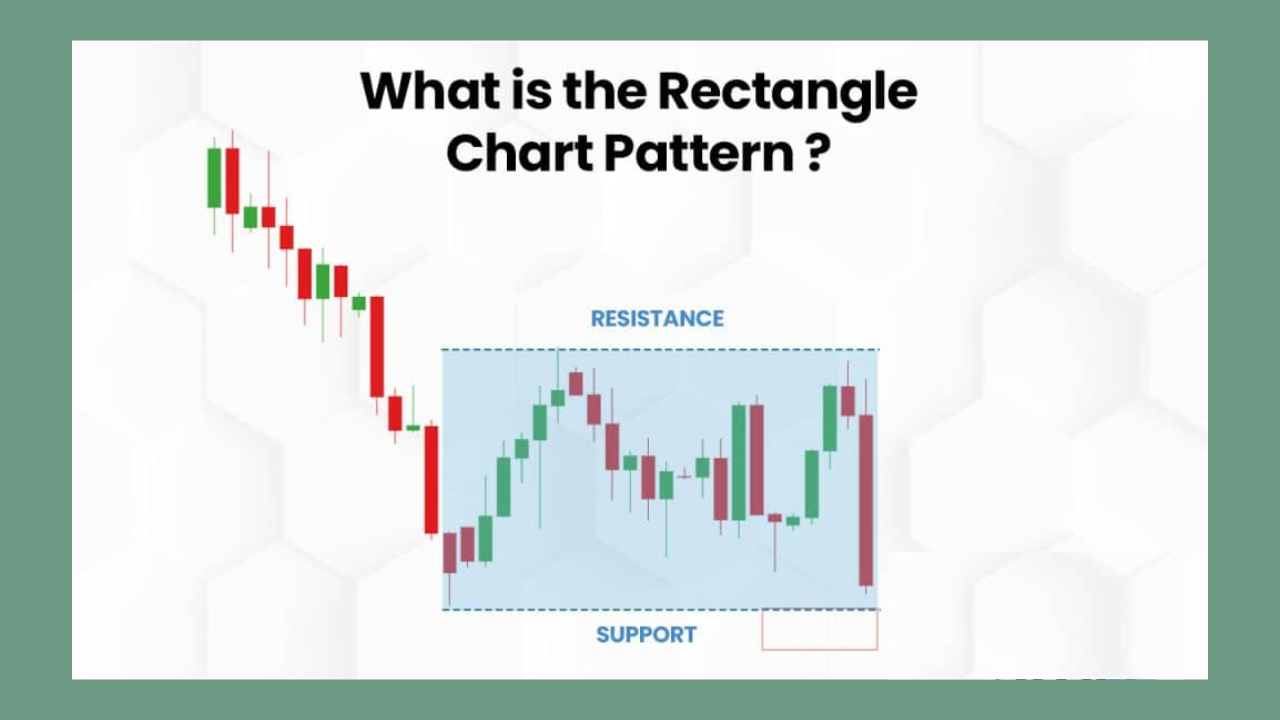

Understanding the Rectangle Chart Pattern: A Foundational Insight

Recognizing the Key Characteristics of Rectangle Patterns

Rectangle patterns appear when a stock or asset’s price bounces between established support and resistance levels. These boundaries create a “box-like” structure, where prices consolidate before breaking out. Traders can think of these levels as the floor and ceiling of a room. Until the breakout happens, the price moves like a ball bouncing within these limits.

Types of Rectangles: Continuation vs. Reversal

Rectangles are often classified into continuation or reversal patterns. A continuation rectangle suggests that the price will break out in the direction of the prevailing trend, while a reversal rectangle hints at a shift in direction. Imagine a stream—sometimes it continues flowing but occasionally changes course entirely. Knowing the difference can help traders better anticipate outcomes.

The Importance of Volume in Rectangle Trading

Volume plays a vital role in rectangle patterns. Increased volume during a breakout often confirms its validity. Think of it like a crowd cheering louder as a team nears victory—it signals something significant is about to happen. Low-volume breakouts, on the other hand, could be false alarms, potentially trapping traders.

Establishing Entry and Exit Points: A Structured Approach

Identifying Breakouts and Managing False Signals

Breakouts are pivotal in trading rectangles. To identify them, traders rely on indicators like volume and candlestick patterns. For example, a price closing above resistance with substantial volume often signals a valid breakout. However, false signals are standard. Many traders liken these moments to mirages in a desert—appealing at first glance but frequently misleading.

Setting Stop-Loss and Take-Profit Levels

A structured approach requires predetermined stop-loss and take-profit levels. Stop-loss orders limit potential losses if the trade moves against expectations, while take-profit orders lock in gains when targets are reached. It’s like having a safety net for unexpected drops while securing wins when goals are met.

Balancing Patience and Action

Trading rectangles demands patience. Entering too early or exiting too late can derail strategies. For example, waiting for a candle to close above the breakout point ensures traders avoid premature decisions. Think of it as watching a cake rise in the oven—opening the door too early ruins the outcome.

Risk-Reward Analysis: Balancing Potential Gains with Market Realities

Calculating Risk-Reward Ratios

The risk-reward ratio helps traders measure the potential reward relative to the risk taken. For instance, risking $50 for a possible $150 gain represents a favourable 1:3 ratio. This calculation ensures that even if some trades fail, the wins cover the losses and yield profit.

Managing Position Sizing to Limit Losses

Position sizing is a cornerstone of risk management. Allocating a small percentage of capital to each trade minimizes the impact of losses. A trader risking 2% of their account on each trade stands a better chance of surviving a string of losses. It’s like budgeting expenses—small, calculated risks prevent financial strain.

Avoiding Emotional Decisions in Risk Management

Emotions often cloud judgment. A trader driven by fear might exit early, while greed could lead to overstaying a trade. Using pre-set risk-reward parameters helps traders stick to their plans. It’s similar to using a GPS for directions—staying on the planned route avoids unnecessary detours.

Adapting Strategies for Market Conditions: Flexibility in Execution

Recognizing Market Trends and Volatility

Markets are dynamic, shifting between trending and sideways movements. Adapting strategies based on conditions is essential. For instance, traders may tighten stop-loss levels in volatile markets to protect gains. In calmer periods, wider stops might allow trades more room to develop.

Revising Strategies Based on Past Outcomes

Every trade, whether successful or not, offers lessons. Keeping a trading journal helps traders refine their strategies over time. Revisiting past trades is like reviewing game footage—it highlights strengths and areas for improvement.

Balancing Aggressiveness and Caution

Flexibility requires knowing when to push boundaries and when to exercise caution. For example, traders might increase position sizes during a high-confidence setup with strong signals. Conversely, during uncertain times, reducing exposure limits risk.

READ MORE

Conclusion

Mastering rectangle chart patterns isn’t just about spotting them—it’s about setting realistic expectations and executing strategies precisely. Traders can confidently navigate these patterns by combining technical insights with disciplined risk management. The journey to trading success lies in adaptability and learning from every outcome. So, how will you turn these patterns into your subsequent trading win?