Mercury Bank Review 2025 – Accounts, Login, & Features

Mercury Bank, also called Mercury, is a modern financial technology company that provides banking services through partner banks in the United States. It is not a bank in the traditional sense, but it works closely with regulated banks to deliver FDIC-insured accounts and a complete digital banking experience.

Mercury was created to help startups, small businesses, and digital-first companies that want fast and flexible banking without the limits of old-fashioned banks. Since its launch, Mercury has become one of the most recognized fintech names in the U.S. It offers both business and personal accounts, cards, international payments, and treasury management. Its clean technology and simple pricing make it very popular among entrepreneurs who value efficiency and clarity.

What is Mercury Bank?

Mercury is a fintech platform that focuses on providing simple and reliable banking services for businesses and individuals. Unlike traditional banks that have physical branches, Mercury is fully digital. Everything is managed online or through the Mercury mobile app. It allows business owners to open accounts, send payments, receive transfers, and issue debit or credit cards, all from a digital dashboard.

Mercury’s accounts are FDIC insured through its banking partners, including Choice Financial Group and Evolve Bank & Trust. This means customer deposits are safe up to the insured limits, just like with any U.S. bank. Mercury also uses a sweep network, which spreads deposits across multiple partner banks to extend FDIC coverage up to millions of dollars. This makes Mercury very appealing to startups that often hold large amounts of investor funding.

History

Mercury was founded in 2017 by Immad Akhund, Max Tagher, and Jason Zhang. The idea came from their own experience as entrepreneurs, where they struggled with traditional banks that were slow, expensive, and not designed for startups.

In 2019, Mercury officially launched its business banking product, targeting small companies and technology startups. The product quickly attracted attention for its easy onboarding process and lack of hidden fees.

Over the years, Mercury expanded its services. It introduced features like corporate credit cards, better treasury management, and accounting integrations. In 2024, Mercury made another big move by launching Mercury Personal, offering individual checking and savings accounts to consumers.

This opened Mercury up to a wider audience, not just businesses. By 2025, Mercury had raised more than $300 million in funding and reached a valuation above $3 billion. Its strong growth has placed it among the most successful fintech companies in the United States.

Mercury Bank Login and Access

Mercury Login

Its login simple and secure. Customers can log in at app.mercury.com/login using their email and password. For extra protection, Mercury requires two-factor authentication (2FA), which means users confirm their login with an additional code. This reduces the risk of fraud and ensures account safety.

Mobile Access

Mercury also provides a mobile app for iOS and Android. Through the app, customers can view balances, transfer money, deposit checks, manage cards, and send wires. The app has a clean design and is rated highly by many users for its speed and ease of use. With the app, business owners can manage finances anywhere without needing a physical branch.

Types of Mercury Bank Accounts

Business Accounts

Mercury is best known for its business checking and savings accounts. These accounts are designed for startups, small businesses, e-commerce stores, and technology companies. They include features like:

- Free domestic wires and ACH transfers.

- Low-cost or free international wires.

- Integration with accounting software like QuickBooks and Xero.

- Permissions for team members with customizable access levels.

- FDIC insurance through partner banks.

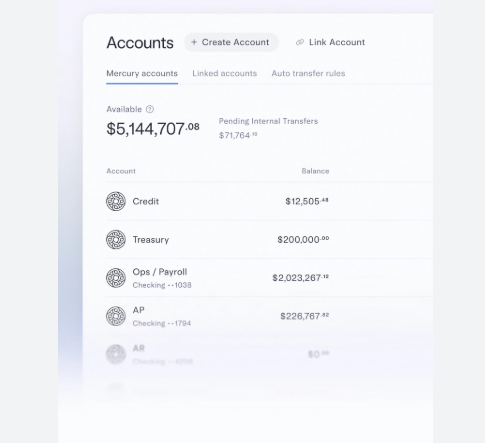

There are no monthly fees for most accounts, making them much cheaper than traditional banks. Businesses can also create multiple accounts under one dashboard, which helps in managing different budgets or departments.

Personal Accounts

In 2024, Mercury launched Mercury Personal. This allows individuals to open checking and savings accounts with the same technology-driven approach. The personal accounts include:

- Joint account access.

- No foreign transaction fees.

- ATM fee reimbursements.

- Interest-earning savings accounts.

- Extended FDIC insurance up to $5 million.

Mercury Personal works on a subscription model, usually around $240 per year, covering all services like free wires and unlimited transactions.

READ MORE

Mercury in the USA and UK

Bank USA

It is primarily a U.S.-based fintech company. To open a business account in the U.S., you must have a U.S.-registered company, such as an LLC, C-Corp, or S-Corp. You also need an Employer Identification Number (EIN) from the IRS. Once you provide these documents, account approval is often quick, and you can begin using the platform immediately.

Mercury Bank UK

Mercury does not have a direct bank presence in the UK. There is no Mercury Bank UK. However, UK entrepreneurs can still use Mercury if they register a company in the United States. This requires setting up a U.S. entity and obtaining an EIN. Once this is complete, founders in the UK can manage their U.S. business finances through Mercury.

It is important to note that Mercury does not serve all countries. Some founders in restricted countries cannot open accounts, even if they have a U.S. company. The eligibility depends on compliance rules and U.S. regulations.

Key Features and Services

Payments and Transfers

Mercury supports ACH transfers, domestic wires, and international wires. Many of these are free or included in the account subscription, which is rare compared to traditional banks that often charge high fees. This makes Mercury attractive for startups working with global clients.

Debit and Credit Cards

Mercury provides physical and virtual debit cards for spending. It also offers a corporate IO Mastercard, which works as a charge card. This card offers 1.5% cashback on all purchases and has flexible limits based on business activity. Virtual cards are especially useful for online payments, giving extra security.

Treasury Management

Mercury has a treasury product that helps companies manage large balances. Through its sweep network, Mercury spreads deposits across multiple partner banks. This increases FDIC insurance protection up to millions of dollars. It also allows businesses to set rules for managing cash flow automatically.

Integrations

Mercury integrates with popular tools such as QuickBooks, Xero, and NetSuite. These integrations make bookkeeping easier and save time for founders who want to focus on growing their businesses instead of manual accounting.

Mercury Bank Logo and Branding

The Mercury logo is simple and modern. It features a circular design with abstract lines next to the word MERCURY in bold uppercase letters. The design reflects movement and energy, representing innovation in the banking industry. The logo is usually displayed in dark gray or black, giving it a minimal yet professional style.

READ MORE

Conclusion

Mercury Bank has become one of the leading fintech platforms for startups and small businesses in the U.S. Its focus on technology, automation, and fair pricing makes it very different from traditional banks. For businesses and individuals looking for fast, digital-first banking, Mercury is a strong option. However, it is important to understand its limits. It does not have branches, and support is not as direct as some competitors. Also, it is mainly designed for U.S. companies, so international founders need to set up U.S. entities to access it.

Overall, Mercury is best for entrepreneurs who value speed, flexibility, and technology in their banking. It continues to grow and innovate, proving that digital-first banking can compete with traditional banks on both security and features.