How Oracles Enhance Transparency in DeFi Staking Platforms

The rapid growth of DeFi staking platforms has transformed how users can passively earn returns and participate in decentralized finance. Through staking, customers can deposit assets into smart contracts and receive rewards, among other benefits, thereby improving network security and liquidity. Nonetheless, transparency and data accuracy are significant issues in DeFi systems, particularly when smart contracts require access to real-world data, including market prices, interest rates, and governance indicators. At this point, decentralized finance (DeFi) oracles become essential.

Oracles are the intermediaries between blockchain networks and external data sources. They provide certified Oracle data to smart contracts, enabling decisions based on reliable, real-time information, including token rewards and collateral ratios. In the absence of oracles, DeFi systems would operate in a vacuum, unable to access the off-chain data they need to run transparently and efficiently. This article will discuss how blockchain oracles enhance transparency, foster trust, and enable the next generation of DeFi staking platforms. It will also explore how companies like Debut Infotech support business initiatives to implement Oracle-based solutions and deliver tangible results.

Understanding DeFi Oracles: The Bridge Between On-Chain and Off-Chain Worlds

In blockchain environments, smart contracts are self-executing programs that automatically carry out agreements based on predefined conditions. However, these contracts cannot access external information such as stock prices, weather data, or exchange rates independently —a problem often referred to as the “oracle problem.”

DeFi oracles address this by feeding external, verified information—known as Oracle feeds—into blockchain networks. This oracle data allows smart contracts to make decisions based on real-time, real-world inputs. For example, a DeFi staking platform might use an on-chain price oracle to determine token staking rewards based on the current oracle stock price or the value of liquidity pool tokens.

There are several types of oracle solutions within the DeFi ecosystem:

- Centralized oracles, managed by a single source of truth.

- Decentralized oracle networks (DONs), where multiple nodes verify and aggregate data before feeding it on-chain.

- Hardware and software oracles, which collect physical-world data, such as IoT sensor readings or web-based APIs.

Among these, decentralized oracle networks are becoming the standard for transparency and security, ensuring that no single point of failure can corrupt the data feeding smart contracts.

Why Transparency Is Vital in DeFi Staking Platforms

Transparency is a fundamental principle of decentralized finance. In DeFi staking platforms, users lock their funds in smart contracts for weeks or months, expecting fair and predictable returns. If the underlying market data or staking parameters are inaccurate or manipulated, users could suffer significant financial losses.

Here’s why oracles are essential for maintaining trust:

- Accurate Reward Calculations: Oracles ensure that staking rewards reflect actual market conditions, including token volatility and liquidity ratios.

- Elimination of Middlemen: By automating data collection through oracles, platforms reduce the risk of human error or manipulation.

- Proof of Integrity: All oracle-supplied data is logged on-chain, providing an immutable record of decisions and transactions.

- Dynamic Adjustments: Real-time data enables staking contracts to adjust yields in response to market shifts automatically.

With these benefits, blockchain oracles are no longer optional — they are foundational to the credibility of the DeFi ecosystem.

The Role of Blockchain Oracles in DeFi Staking

To understand how oracles enhance staking mechanisms, it’s essential to examine their functionality within DeFi staking platform development.

When a user stakes tokens, a smart contract determines the rewards or penalties based on external variables, such as the token’s price, the liquidity pool ratio, or the validator’s performance. The Oracle network supplies this data, ensuring the contract operates based on verified inputs.

For instance:

- A DeFi price feed might provide the live value of ETH or BTC to calculate staking yields.

- An Oracle feed could report governance token results, triggering automated changes in staking parameters.

- Oracles can also support on-chain price oracles that constantly update staking contracts with decentralized data from multiple exchanges.

This automation not only improves fairness but also eliminates information asymmetry—enabling all users to verify the same data in real time.

Types of Oracle Data in DeFi Platforms

Different oracle solutions address various use cases across staking and yield farming platforms. Here are the key data categories:

- Market Data: This includes token prices, liquidity ratios, and volatility indexes pulled from exchanges or aggregators. Accurate market data ensures fair reward distribution and prevents market manipulation.

- In DeFi protocols with governance tokens, oracles record and verify votes, ensuring that decisions are transparent and tamper-proof.

- Performance Data: In validator-based systems, oracles monitor node uptime and reliability to ensure rewards are distributed to legitimate participants.

- Cross-Chain Data: Multi-chain staking solutions rely on oracles to synchronize token values and liquidity information across blockchain networks.

Together, these data layers make DeFi staking platforms more autonomous and resistant to corruption.

Advantages of Oracle Integration in DeFi Staking Platforms

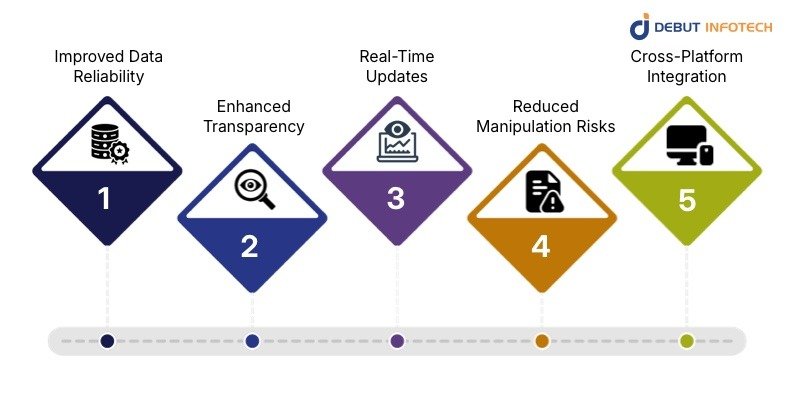

Oracles bring several tangible advantages that make DeFi systems more robust and appealing to both investors and developers:

- Improved Data Reliability: Using a decentralized oracle network enables DeFi platforms to access multiple independent data sources and verify their accuracy before feeding them into smart contracts.

- Enhanced Transparency: Every transaction and oracle update is recorded on-chain, allowing anyone to audit staking rewards or contract activity.

- Real-Time Updates: Oracles ensure that market fluctuations are instantly reflected in staking contracts, preventing outdated data from affecting yield rates.

- Reduced Manipulation Risks: Unlike centralized feeds, decentralized oracle systems distribute data verification among multiple participants, reducing the chances of fraud.

- Cross-Platform Integration: Oracle solutions enable DeFi development companies to build staking solutions that integrate seamlessly across multiple blockchains and dApps.

These advantages collectively drive trust, user adoption, and growth across the DeFi ecosystem.

How Oracle Networks Ensure Accuracy and Trust

A significant concern in decentralized finance is ensuring that the external data feeding into smart contracts is both correct and verifiable. To address this, Oracle networks rely on multiple validation mechanisms:

- Aggregation: Collecting data from several trusted providers and computing a weighted average.

- Reputation Scoring: Tracking the reliability of oracle nodes over time to prevent manipulation.

- Economic Incentives: Rewarding accurate data providers and penalizing malicious ones.

- Cryptographic Proofs: Using secure signing mechanisms to ensure that data hasn’t been tampered with before reaching the blockchain.

By combining these elements, oracles create an ecosystem of Oracle data integrity that aligns incentives for transparency and accuracy.

Market Outlook: The Growth of Oracle-Integrated DeFi Platforms

As DeFi matures, the oracle market continues to grow at an impressive pace. According to current crypto market data, the adoption of oracle solutions has expanded across exchanges, derivatives, lending protocols, and DeFi staking platforms.

Emerging players such as Chainlink, Band Protocol, and API3 are pushing boundaries in decentralized data verification, while new companies offering oracle integration for DeFi are building hybrid architectures that connect on-chain and off-chain ecosystems.

The Oracle stock price trend—reflecting the performance of major Oracle projects—also signals growing demand for reliable, scalable Oracle networks as DeFi becomes more institutionalized.

Implementation Challenges in Oracle Integration

Despite their many benefits, oracles are not without challenges. Common Machine Learning Challenges in this domain include:

- Data Quality Risks: Even decentralized networks can be vulnerable to corrupted or manipulated off-chain sources.

- High Gas Costs: Frequent data updates can increase transaction costs for DeFi staking platform development.

- Latency Issues: Real-time data feeds must balance speed and accuracy.

- Complex Integration: Deploying oracles requires deep expertise in smart contracts and data feeds.

That’s why many projects turn to a DeFi development company like Debut Infotech to handle integration, ensuring reliability, scalability, and compliance throughout the development cycle.

How Debut Infotech Helps Businesses Build Transparent DeFi Platforms

Debut Infotech, a global blockchain development company, specializes in building secure, transparent, and scalable decentralized systems. With deep experience in DeFi staking platform development, the company helps businesses integrate oracle solutions that seamlessly bridge off-chain data with on-chain smart contracts.

Here’s how Debut Infotech adds value:

- Oracle Integration Expertise: Implementing decentralized oracle networks to ensure accuracy, transparency, and real-time updates in DeFi systems.

- Innovative Contract Development: Crafting secure contracts that automate staking, yield distribution, and governance functions.

- Custom Blockchain Solutions: Building tailored blockchain oracles and interoperability layers to connect with multiple blockchain ecosystems.

- End-to-End Support: From concept to deployment, Debut Infotech manages the entire lifecycle, including maintenance, upgrades, and Oracle security auditing.

By combining technical mastery with a client-centric approach, Debut Infotech enables startups and enterprises to unlock the full potential of DeFi oracles for greater market transparency.

The Future of Oracle-Enhanced DeFi

As blockchain technology evolves, oracle networks are expected to become the backbone of decentralized applications. The integration of DeFi staking platforms with Oracle data will enable self-regulating ecosystems where financial interactions are transparent, automated, and tamper-proof.

We can anticipate:

- Cross-Chain Interoperability: Oracles that aggregate data from multiple blockchains into unified DeFi dashboards.

- AI-Powered Oracles: Integration of artificial intelligence to predict data anomalies and enhance real-time decision-making.

- Institutional Adoption: Enterprises adopting blockchain development services to tokenize assets and integrate staking protocols backed by trusted oracles.

READ MORE

Conclusion

The role of oracles in DeFi staking platforms extends far beyond simple data feeds. They are the unseen infrastructure ensuring every smart contract operates transparently, every transaction reflects accurate market data, and every user can trust the outcome. As DeFi continues to expand, oracles will be the key to bridging the gap between blockchain isolation and real-world interaction.

Partnering with an experienced team like Debut Infotech ensures that businesses can harness these innovations with confidence. Through its expertise in blockchain oracles, innovative contract development, and DeFi staking platform development, Debut Infotech empowers organizations to create transparent, data-driven DeFi ecosystems that inspire user trust and set new standards for transparency in decentralized finance.