The Ways Businesses Utilize Financial Forecasts To Thrive

“Can you predict your business’s future?” Financial projections provide insight into the future, directing choices and propelling expansion. Consider them a financial GPS that can help you locate the quickest path to achievement and avoid obstacles. Businesses that used accurate forecasts grew by 20% in 2024. To succeed in a competitive environment, it is imperative to comprehend these instruments. Can financial forecasts drive smarter market decisions? Here are the education firms which link traders with professionals who unravel the intricacies of predictive strategies through educational insights.

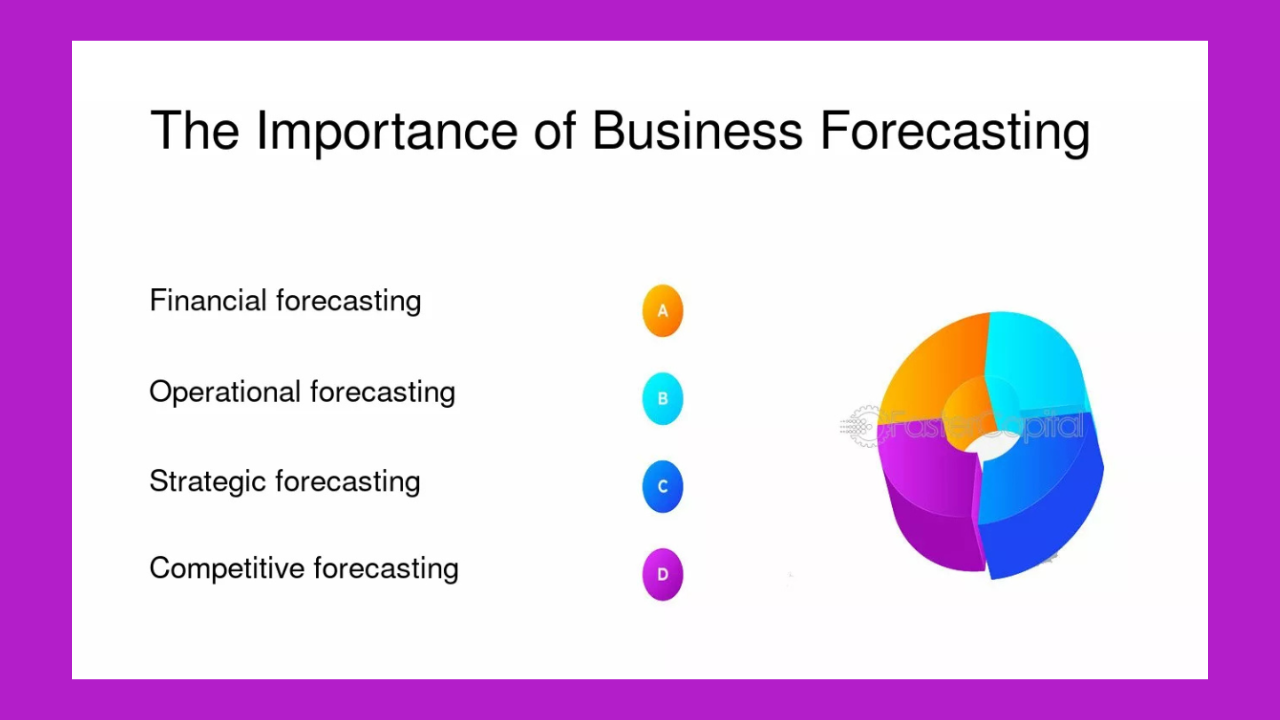

Aligning vision and strategic planning

Strategic planning is the compass that directs companies toward their long-term objectives. Financial predictions are essential in forming these plans, as they give a precise picture of future revenues and expenses. Consider embarking on a voyage without a chart; financial predictions guarantee that the journey stays on course.

Businesses can prioritize growth-promoting efforts by matching financial estimates with business objectives. For example, a tech startup may predict that demand for its software will rise, leading to research and development expenditures. This alignment promotes sustainable growth by ensuring that resources are allocated where they are most needed.

Financial predictions also assist companies in modifying their plans in response to shifting market conditions. Let’s say a retailer expects a change in consumer spending habits. That way, it may stay ahead of the competition by realigning its strategy to concentrate on e-commerce. By being proactive, opportunities are maximized, and dangers are reduced.

Strategies for Investment and Capital Allocation

Allocating capital effectively is essential to optimizing profits and guaranteeing the life of an organization. Decisions about where to allocate resources—whether for business expansion, product introduction, or market expansion—are influenced by financial projections. Consider capital allocation, such as gardening, where the best crop is produced by planting seeds in the proper places.

Businesses use forecasts to pinpoint high-potential regions. For instance, a manufacturing company may invest more money in developing a particular product line after projecting a rise in demand. This focused investment guarantees growth without overburdening resources.

Financial forecasting helps investment plans by evaluating the feasibility of possible projects. Businesses can rank projects that yield the highest returns by examining anticipated cash flows and return on investment. This methodical approach reduces the hazards connected with bad investing decisions.

Competitive Advantage and Market Positioning

To stand out in a crowded market, one must comprehend market positioning. Financial predictions provide the information required to assess a company’s advantages and disadvantages in comparison to rivals. It’s like possessing a crystal ball indicating where one should shine the brightest.

Businesses might find niches where they can thrive by examining future revenues and market share. For instance, a beverage firm may create a new line of organic drinks in response to the increased demand for health-conscious products. This calculated action draws in a particular clientele and distinguishes the brand.

Anticipating market trends also gives you a competitive edge. Financial projections help businesses quickly adjust by highlighting new opportunities and possible risks. A company can speed up its development to keep its advantage if a rival is anticipated to release a comparable product.

Investor relations and stakeholder communication

Establishing trust and obtaining investment need open and honest communication with stakeholders. A financial forecast is essential for communicating a company’s economic health and prospects. It’s similar to giving investors a roadmap and reassuring them of the path ahead.

Businesses can illustrate their strategic plans and anticipated results by offering predictions. Investors are reassured by this openness that the business is ready for upcoming possibilities and difficulties. To attract investors who care about the environment, a renewable energy company can, for instance, highlight its anticipated expansion based on the growing need for sustainable solutions.

The effective use of financial predictions in communication further demonstrates a company’s dedication to responsibility. Frequent reports on economic performance compared to projections reassure stakeholders and encourage their continued support by showing that the company is on course.

Furthermore, providing stakeholders with thorough forecasts helps them make well-informed decisions. By better understanding the possible risks and benefits, shareholders are better equipped to make wise investment decisions. At this level of involvement, relationships are strengthened, and further investment is encouraged.

Consulting with financial communication professionals can improve the way projections are communicated. These experts ensure that information is compelling, clear, and succinct so stakeholders can more efficiently understand the company’s mission. A good story is worth a thousand spreadsheets, after all.

READ MORE

Conclusion

Financial predictions help businesses make informed plans and manage resources efficiently. Enterprises use these forecasts to address obstacles and grasp opportunities, resulting in long-term growth. When financial forecasting is adopted, uncertainty becomes a competitive advantage. Are you prepared to improve your company’s future? Make predictions for a resilient future now.